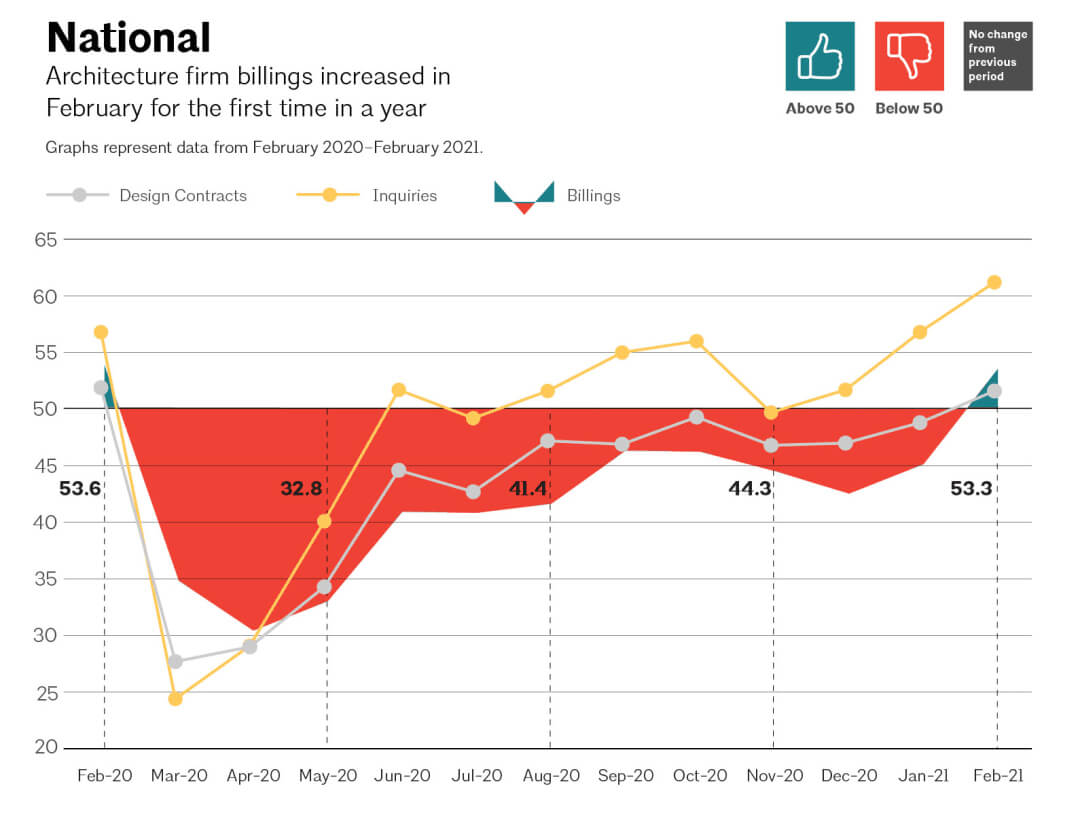

Could the architecture industry be wobbling its way to a recovery? The February 2021 Architecture Billings Index (ABI) figures seem to indicate that things are finally looking up for the first time since the start of the COVID-19 pandemic.

As the AIA reported yesterday, March 24, upon release of the new numbers, the February ABI hit a whopping 53.3 (anything over 50 is an increase from the month prior, under 50 a decrease), the first time the Architecture Billings Index has trended positively since February of 2020. AN’s past coverage of the monthly ABI figures has been a bit dour as the index tumbled every single month in response to the pandemic and global recession it caused, but demand seems to have potentially turned a corner.

“Hopefully, this is the start of a more sustained recovery. It is possible that scores will continue to bounce above and below 50 for the next few months, as recoveries often move in fits and starts,” wrote AIA Chief Economist, Kermit Baker, in the ABI announcement. “Beyond the encouraging billing data, architecture employment added 700 new positions in January and has now regained 45 percent of the jobs that were lost since the beginning of the pandemic.”

The ABI is a composite measure of project inquiries, newly signed design contracts, and national and regional project billing, and accordingly, many of those individual measures also rose from January 2021.

The new project inquiries index continued to be a particular bright spot, rising to a whopping 61.2 in February from 56.8 the month before, a 22-month high mark indicating that developers and homeowners are looking to start building again. Accordingly, the design contracts index, representing signed contracts, hit 51.6 (up from 48.8 in January), meaning money is finally being thrown behind that increased interest.

On a region-by-region basis, most of the country seems to be reaching rock bottom for how low billings can fall, while the South actually saw billings increase to 52.4, from 47.4 in January. In the West, demand hit 49.5 from 42.8 (meaning it only decreased slightly); the story was the same in the Midwest, as demand remained somewhat steady at 49.3, up from January’s 42.2. The Northeast, which has been battered by the pandemic demand-wise, saw billings drop yet again, falling to 46.9 in February from 41.9. Technically better, but still a decrease.

There were also a few surprises in the sector demand breakdown last month. Firms working in the commercial and industrial sector have been hit hard as lockdowns kept people at home for the last year, but demand for their services rose to 50.5 in February, up from a dismal 44.3 in January, indicating that developers are again thinking about the future of in-person retail and manufacturing. Institutional demand has taken a beating as well, but things turned slightly positive in February as billings went from 39.9 in January to 47.8. Residential demand moved from 44.4 to 48.3 in February. Finally, firms doing mixed-practice work gained the most ground, as demand for their services shot up to 52.5 in February from 47.9 the month prior.

Perhaps most telling is the survey the AIA conducted of its members about their office habits pre- and post-pandemic, as a large number indicated their staff had been, and will continue to, work from home. While 74.4 percent of staff worked in the office with only occasional remote work previously, that number fell to 56.5 percent during the COVID era. Accordingly, the number of workers physically coming in only three-to-four days a week rose from 5.1 percent to 20.2 percent. It seems that architects are still going into the office, but as vaccinations increase and we turn the COVID corner, remote working (at least flexibly) is here to stay.